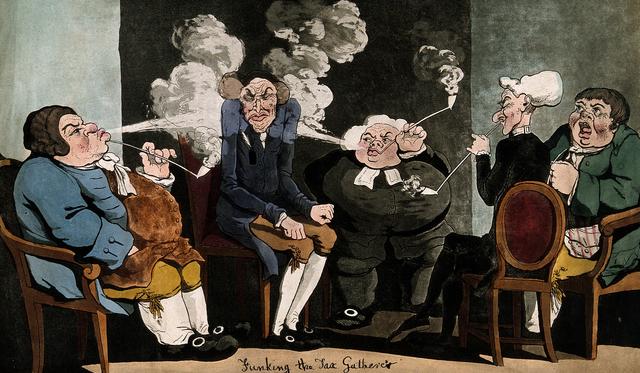

The Tax Man Cometh

The Tax Man Cometh

A former IRS tax attorney warned of a coming “tsunami” of audits related to industry-hated tax rule 280E. Speaking to MJBiz, the attorney said changes in IRS policy could cost larger cannabis companies millions in unpaid taxes and penalties.

Nick Richards, whose clients now include cannabis companies, said he’s heard from his former colleagues at the IRS that unsuccessful court challenges to 280E by Harborside and Alternative Healthcare Advocates expanded the scope of 280E in a “big, big, big way”

- “According to Richards, the IRS now considers unlicensed companies that work with plant-touching businesses as subject to 280E if they profited from marijuana sales – including the likes of management companies, landlords, leasing firms, etc., but clarity does not exist yet.”

- The other issue, he says, is the IRS is ramping up enforcement of the anti-laundering Bank Secrecy Act which requires the filing of Form 8300 with all cash payments over $10,000. If it plays hardball, the IRS could go back years into a company’s past and levy a fine of $25,000 per missing form.

- Richards anticipates the number of these audits expanding, especially in Colorado and California, in coming years.

- The IRS declined to comment on Richards’ guidance.